are dental implants tax deductible in canada

Payments of fees to doctors dentists surgeons. A dental implant is a tax-deductible expense yes.

Are Dental Bills Tax Deductible In Canada Ictsd Org

Your income tax should include dental expenses for your deductible medical expenses if your income is for your dental expensesAmong the dentistry expenses covered by your insurance plan are fillings dentures dental implants and other dental work not covered.

. 502 Medical and Dental Expenses but its not exactly in plain English. In order to help ease the burden of this costs the Canada Revenue Agency accepts medical expense deductions to the extent that your taxable income exceeds 50000. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20.

The only exception is dental work that is purely cosmetic such as teeth whitening. Other dental work not paid by your insurance plan. Yes Dental Implants are Tax Deducible.

You can only have seven good things to remember right now. You can claim the portion of the procedure that you pay also known as the co-pay. Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including.

Are dental implants tax deductible in canada. A taxpayer who earns 5000 a year is entitled to deduct 5 of his or her gross income. Tax deductions for gross income are available to people with a total income of 5.

The only dental work that is not covered is cosmetic work such as teeth whitening which is not. When you have a medical policy which covers crowns this cannot be deducted. Can I Claim Dental Expenses On My Income Tax Canada.

All dental implants are tax deductible. Yes dental implants qualify as a tax-deductible medical expense under current Revenue Canada guidelines. This is not an odd question at all.

That 20 is the portion you can. Dentures and dental implants. The good news is yes dental implants are tax deductible.

In order to help you with this cost the canada revenue agency allows you to deduct dental expenses from your income tax when filing. Qualified costs are limited to expenses paid for cure diagnosis mitigation prevention or treatment of disease including dental and vision costs. A letter from a medical practitioner explaining and certifying the reason for the implants would be required.

You need to itemize it. It also explains Medical care expenses include payments for the diagnosis cure mitigation. In fact it is not automatically deducted.

Taxpayers will be able to deduct dental implants from their income for taxable purposes. Any 7 should be regarded as a good thing to remember. You can incur health care expenses from fillings dentures dental implants and anything else that is not covered under your policy.

To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. The IRS addresses this in Topic No. Dental Insurance Dentist NW Calgary Metro Dental Care from metrodentalcareca.

Are Dental Expenses Tax Deductible In Canada. In fact it shows great foresight. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit.

If this was purely for cosmetic purposes you cannot claim it as a medical expense. Per the IRS Deductible medical expenses may include but arent limited to the following. Dental expenses includes fillings dentures dental implants and other dental work that is not covered by your insurance plan.

Per the IRS Deductible medical expenses may include but arent limited to the following. Are Dental Crowns Tax Deductible In Canada. As long as the equipment is used maintained and purchased you can claim the amount spentThe premiums paid for health plans involving medical dental and hospitalization servicesIt may be considered a medical expense if 90 or more of the premiums that members pay under the plan qualify for reimbursement.

There are no automatic deductions so you must itemize them. If however it was necessary for medical reasons or reconstructive purposes it can be claimed.

What Is The Monthly Cost Of Insulin In Canada

Are Dental Implants Tax Deductible In Canada Ictsd Org

Are Dental Expenses Tax Deductible Canada Ictsd Org

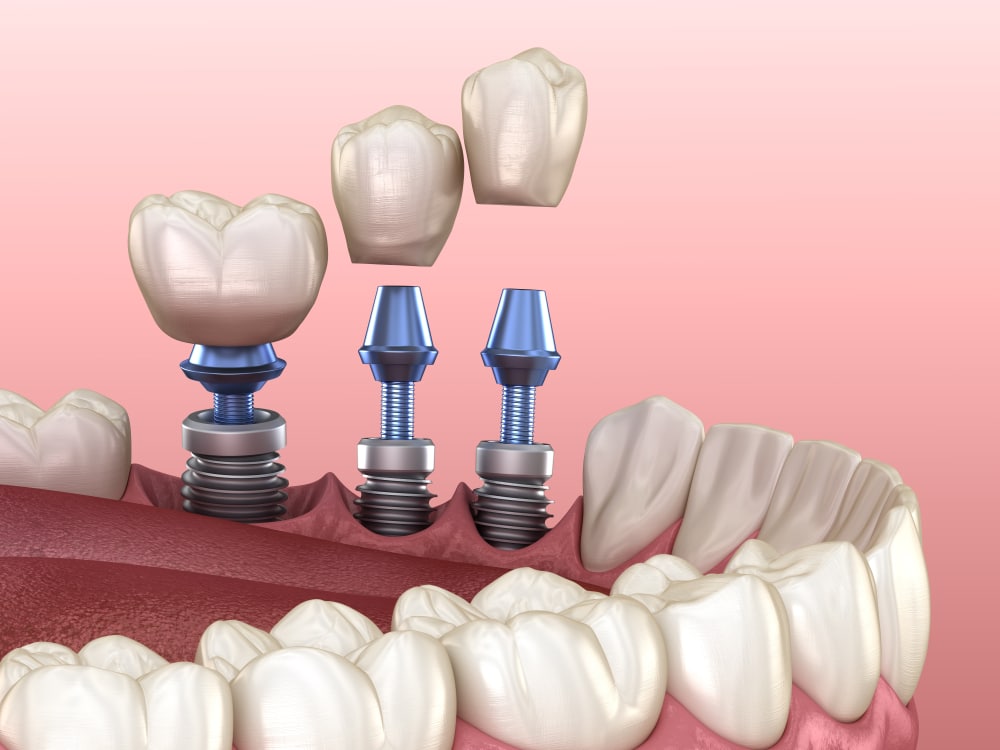

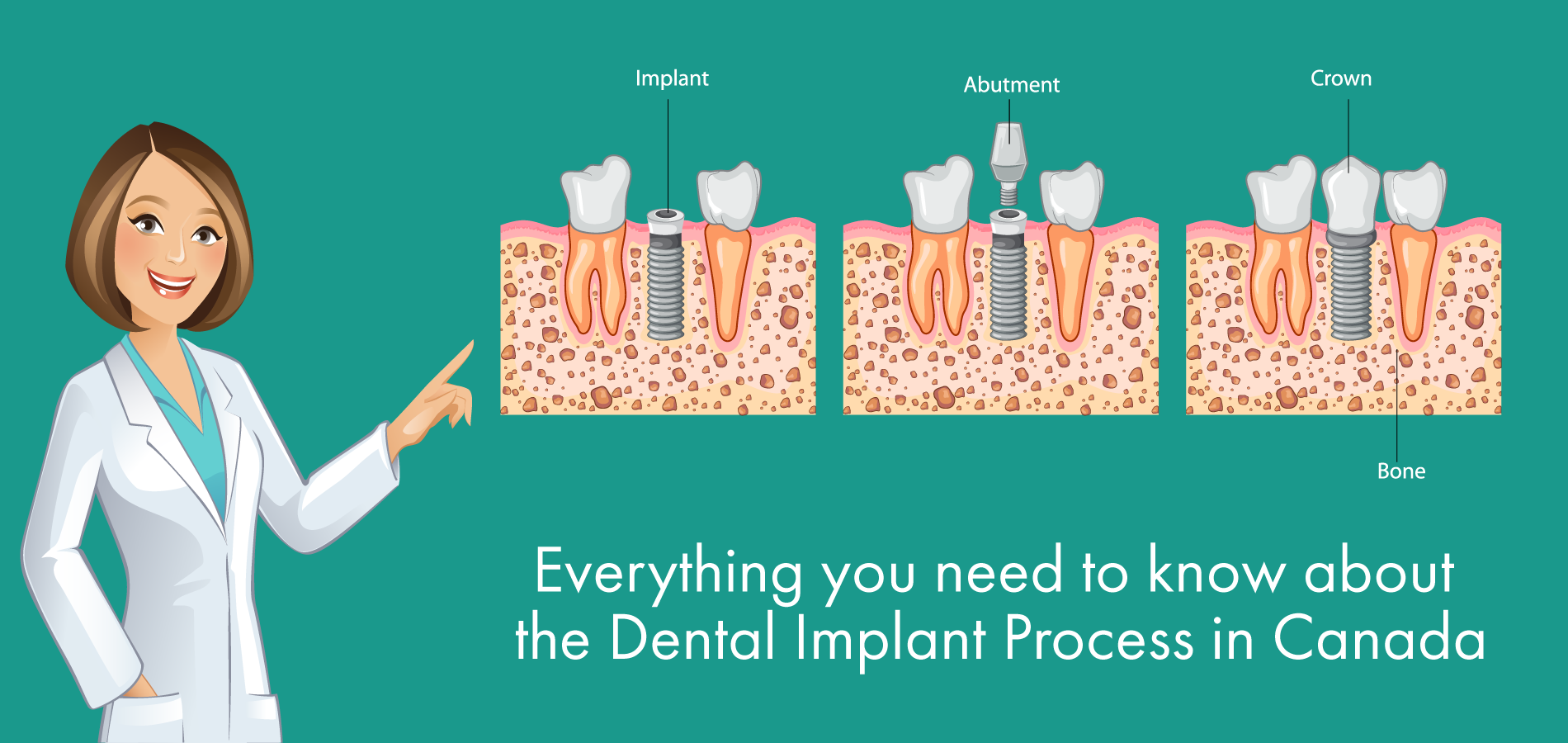

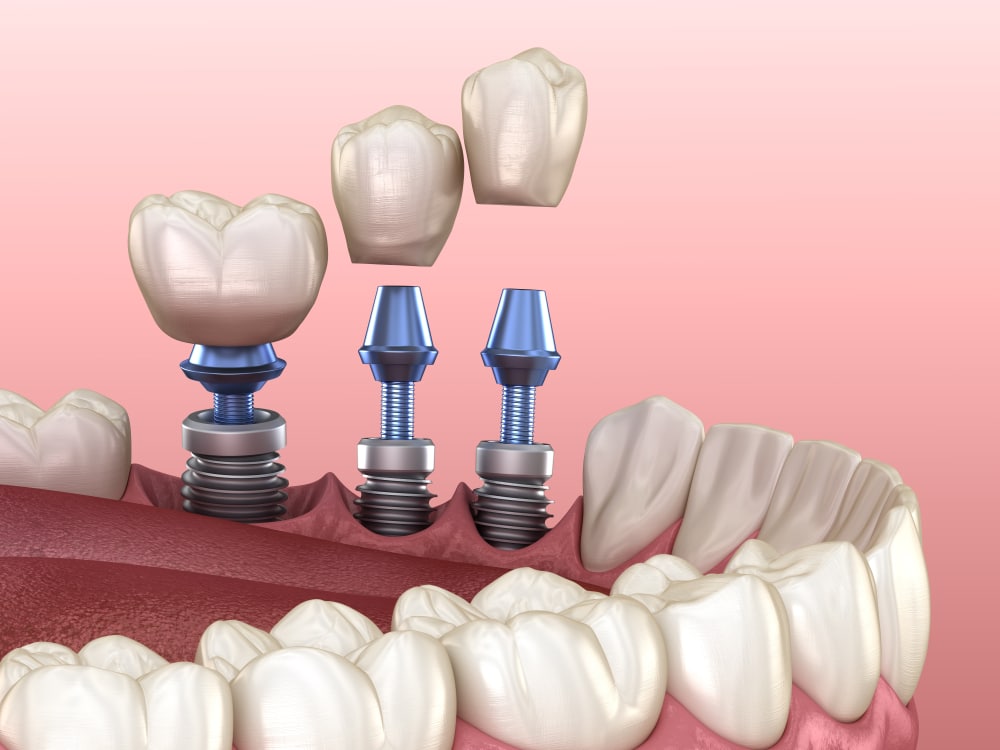

Everything You Need To Know About The Dental Implant Process In Canada

Are Dental Expenses Tax Deductible In Canada Ictsd Org

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Are Medical Insurance Premiums Tax Deductible In Canada Cubetoronto Com

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Dental Implant Cost Dental Implants Start From 900

Can I Claim Dental Implants On My Taxes In Canada Ictsd Org

Are Dental Crowns Tax Deductible In Canada Ictsd Org

Dental Implant Cost Near Me Clear Choice Cost Maryland

Are Dental Costs Tax Deductible In Canada Cubetoronto Com

What Percentage Of Dental Expenses Are Tax Deductible In Canada Ictsd Org

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca