estate and gift tax exemption sunset

The current exemption will sunset on Dec. Everything else in your estate would be subject to.

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Duckett Law Office

On January 1 2026 absent legislative action the Federal Estate Tax Exclusion is still set to sunset back to its pre-2018 level of 5 million adjusted for inflation.

. For instance if you have two children and four grandchildren you can give each. Unless your estate planning is. Gift and Estate Tax Exemption.

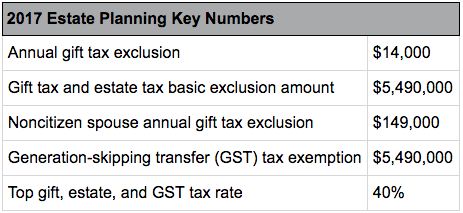

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. Under the gift tax exclusion you can give each recipient up to 15000 in 2019 exempt from any gift tax liability. The lifetime gift tax exemption is increased to 12920000.

However the TCJA will sunset. Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

In 2018 the Tax. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset.

This exemption applies to both gifts and estate taxes as using any of this portion will decrease the amount you can use for the estate tax. The enhanced exemption amounts are scheduled to sunset at the end of 2025 and revert to levels in the 6000000 range unless Congress proactively takes action to extend. Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear.

This means that a married couple can shield a total of 25840000 without having to pay any federal estate or. The amount you can give during your lifetime or at your death and be exempt from. The IRS has come out with the exemption amounts for 2023.

This means that to use up your extra estate exemption before it sunsets you could consider making gifts either directly to heirs to an irrevocable trust or to a 529 plan. However the TCJA will sunset. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018.

Every donor has a separate lifetime. Fast-forward to 2026 and the estate and gift tax exemption amounts will. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

However the logical objection to this notion is that once the gift and estate tax exemption amount sunsets in 2026 and reverts back to pre-TCJA levels one can assume that. In November 2019 the IRS issued regulations stating that it would not claw back taxes on a large lifetime gift made after the exemption amount is reduced. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation.

Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear. 20 2018 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when. Fast-forward to 2026 and the estate and gift tax exemption amounts will.

This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the threshold. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. The adjusted exemption in 2026 is projected to.

After that the exemption amount will drop back down to the prior laws 5 million cap which. If you then died in 2026 or later the 10 million taxable gift would be your new estate tax threshold instead of 68 million.

The Federal Gift And Estate Taxes Ppt Download

Avoid Estate Tax Tips Advice Rabalais Estate Planning Llc

2015 Federal Estate And Gift Taxes Explained Florida Probate Lawyers Pankauski Hauser Lazarus

The Generation Skipping Transfer Tax A Quick Guide

Watching The Sunset Current Estate Tax Laws Vs New Proposals Bdf Llc Bdf

Impact Of Tax Laws Changes On Estate And Gift Taxes What You Need To Know And How To Act On It Now Credo Cfos Cpas

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Law Money Matters

2021 Federal Gift Estate Tax Exemption Update Sessa Dorsey

Federal Estate Tax Exemption 2021 Cortes Law Firm

Estate Tax Exemptions Trust And Estate Planning Armanino

Gift Tax Returns Must Be Filed Or Extended By 4 15 20 Weaver

Sitting On 11 Million Give It Away To Save On Estate Taxes

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Why Gifting Now Can Save On Future Estate Taxes Middle Market Growth

Before The Estate Tax Exclusion Sunsets In 2026 Marotta On Money

Estate Planning Opportunities In 2020 Homrich Berg

Four More Years For The Heightened Gift And Tax Estate Exclusion

An Evaluation Of The Future Of Federal Estate Tax Koss Olinger

Will The Lifetime Exemption Sunset On January 1 2026 Agency One